Complex Things Well-Explained and Visualized

Learning is a gradual process and, as is especially the case for adults living in these ever-changing times, keeping up with the complexities of a modern world is next to impossible for a population already short on free time. With more and more intricate scenarios being placed at our feet on an almost daily basis, falling behind means losing touch.

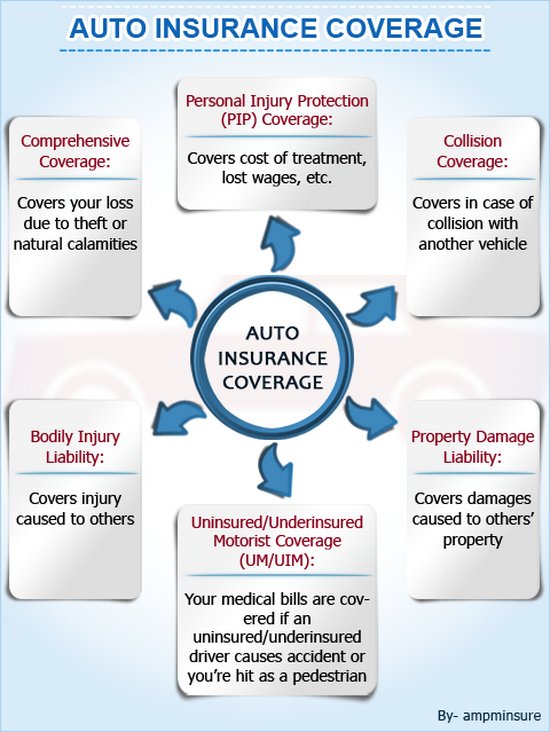

In the name of a better understanding of one of the most difficult-to-understand concepts that we face in our daily lives, here are the two main aspects auto insurance well-explained and visualized:

1. Auto Insurance Policies

By ampminsure.org via autoinsurancequotes.net

While the complexity of purchasing and maintaining auto insurance may be exaggerated at times, the many facets of the industry dictate that at least some self-education be undertaken by those wishing to understand the ins and outs of their policy and rate.

There are three basic types of auto insurance – understanding what each of them covers is the first and most important step in gaining a good working understanding of auto insurance and how it works:

Third Party Auto Insurance

Third party auto insurance is the most basic coverage that you can purchase, covering only the third party’s damages in the event of an accident. For example, if you are involved in an accident that sees damages to your car and the car of the other driver, third party car insurance will cover the damages to the other driver’s car only, not yours.

This form of insurance offers no protection for your damages and no protection against contingencies such as theft and fire.

Third Party Fire and Theft Insurance

Third party fire and theft insurance is considered to be at the middle of the scale, providing coverage for third party damages in an accident as outlined above while adding protection against accidental fire and theft as well.

Because of the generally incremental price increase in comparison with basic third party auto insurance, this level of insurance is the most commonly purchased type by average drivers.

Comprehensive Auto Insurance

Comprehensive auto insurance offers the highest level of coverage available to drivers, providing coverage in the case of an accident for your damages and the damages of the other driver, regardless of who is responsible for the accident and whether or not the other driver is insured.

While the luxury of comprehensive coverage is attractive to all drivers, its high cost often makes it a prohibitive choice for average drivers purchasing auto insurance.

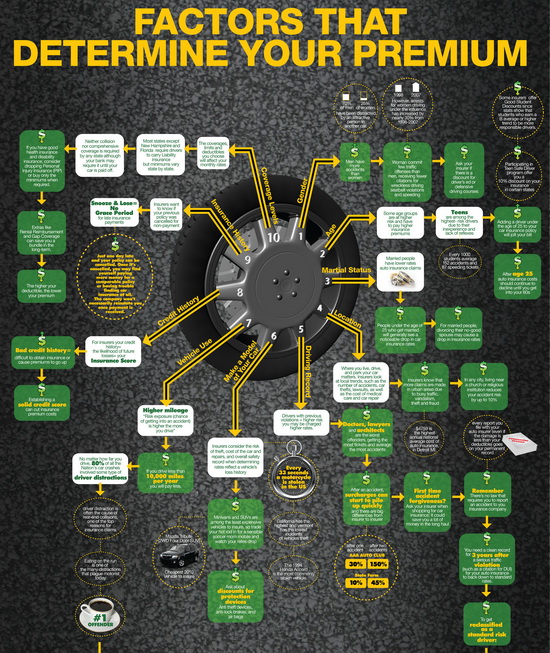

2. Auto Insurance Rates

While not as easily explained as car insurance policies due to the number of variables that come into play, car insurance rates can be better understood by those outside of the insurance industry by simply familiarizing ourselves with the many factors that have an effect on them:

Your Vehicle

The make, model and year of your vehicle will affect your insurance costs in varying ways.

Your Driving Record

Have a history of bumping into objects with your car? Your rates will most definitely be higher than average.

Your Coverage History

Generally speaking, the longer you’ve been safely covered by an insurance company, the more insurance companies will trust you; gaps in coverage often lead to higher than expected rates.

Where You Drive

Drivers in urban areas tend to pay more for car insurance across the board.

How Much You Drive

Drivers with high annual mileage often pay higher rates given their increased risk of an accident.

Your Credit Score

While not factored in by all auto insurance companies, your credit history does often play a role in determining the rate that you’ll pay.

Conclusion

While every auto insurance company calculates rates differently, these six main factors are guaranteed to serve as the most important measures of your accident risk status, the final and most important variable when it comes to determining the auto insurance rates that you’ll pay.

amazing information.. i enjoyed reading your blog..keep updating it.

Perfect as ever when you post your articles.